What may be best for Colorado K-12 schools is BEST, a proposal by Democratic legislative officials that would use federal mineral lease revenues to leverage up to $1 billion toward capital construction projects to build or repair schools. The Building Excellent Schools Today (BEST) plan would not raise taxes or take funds out of the state’s general fund, according to Senate President-elect Peter Groff (D-Denver.)

Much of the federal mineral lease monies are already dedicated to schools, with revenues in 2004 climbing from $47 million to an anticipated $90 million in 2008 because of the increase of oil and gas exploration on School Trust Lands, a federal program established in 1876 when Colorado was granted statehood.

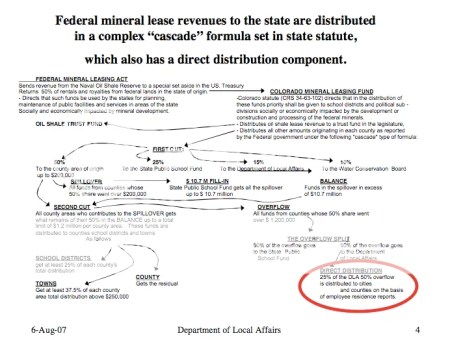

Colorado collects income from mineral lease revenues, royalties, rents and interest on about 3 million acres under a complicated distribution system. (See graph below.) This program has built up a $500 million cash fund, according to an article in The Denver Post:

Top Democrats…are proposing to take $30 million to $40 million each year for the next 20 years – about a third of the amount the fund generates in interest and lease payments. The state could increase the first year’s allotment up to $450 million by financing new school buildings through private investors, state Treasurer Cary Kennedy estimates.

Under the plan – which is up for debate by the legislature in January – the state would take up to $40 million from the nearly $100 million the fund generates each year for two decades. The annual withdrawals would pay back the state’s debts on school construction projects.

School districts will be asked to match grant applications up to $400 million that could create a $850 million construction funding pool.

School districts will be asked to match grant applications up to $400 million that could create a $850 million construction funding pool.

Federal mineral lease monies are not subjected to TABOR regulations and, therefore, changes in revenue distribution or use can be made by the Legislature.

The BEST proposal looks similar to the measure that some of the members of the special legislative severance tax committee had backed for higher education. It created a higher education capital construction fund consisting of specified federal mineral leasing payments credited to the fund and it specified the fund may be appropriated to pay for or finance capital construction projects for state-supported institutions of higher education approved by the Colorado commission of higher education. That measure failed to get the full support of the severance tax committee.

BEST supporters listed how the funding would be prioritized:

The first step for the BEST Program will be to conduct a statewide assessment of the health and safety needs of our schools.

Once that assessment is done, grants will be awarded based on a few guiding principles:

–Meeting health and safety standards

–Helping poor, rural districts that have the oldest infrastructure

–Building 21st century schools throughout Colorado

“Every child deserves a safe, healthy place to go to school,” said House Speaker Andrew Romanoff, (D-6,) who backs the BEST proposal. “It’s tough to learn when the roof is caving in or your desk is falling through the floor. The quality of your education shouldn’t depend on your ZIP code. We can do better.”

Comments are closed.