The severance tax legislative committee has been meeting over the summer to decipher the state’s severance tax distribution formulas. Tuesday was another long day of hearings and discussions about mineral revenues as the legislative members and their advisory citizen sub-committee examined how and where the tax money is being used.

This group is finding the severance tax distribution system confusing, if not almost overwhelming to understand. Is it time to start all over? Please read on….Severance taxes are collected on oil and gas, coal, metals, methane and oil shale among other minerals and energy related products extracted on federal lands. These taxes are widely distributed among state agencies, schools, communities and other entities. But have the distribution formulas been fair? Some say “no.”

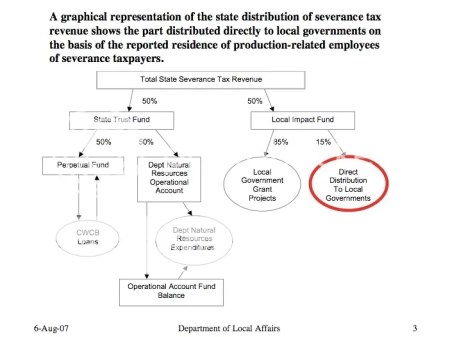

The Department of Local Affairs, which distributes part of the severance tax collections to areas impacted by energy development, presented the severance tax committee members with graphs showing the distribution of severance taxes within the state.

The first diagram left breaks down the state severance tax collections and how they are allocated throughout the Department of Natural Resources. (“CWCB” stands for Colorado Water Conservation Board which funnels money to state water projects.) (Note for a better view, go here, page 3.)

The red circle represents funds that go to communities directly affected by energy development. These entities such as local governments, school systems and hospital districts can also apply for the general DOLA local government grant projects, but they must provide a monetary match with their request.

In 2008, the direct distribution in the red circle will increase to 30% and the DOLA grant pool will drop to 70% as result of 2007 House Bill 1139.

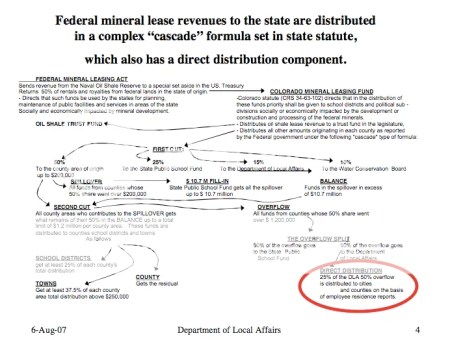

This second graph to the right represents the distribution of federal severance taxes in the state. “Overflows” and “spillovers” sound more like a sewer system than a financial chart. (Note for a better view, go here, page 4.)

In an interview with Rep. Bernie Buescher (D-Grand Junction), Grand Junction Daily Sentinel reporter Mike Saccone noted the formula has been described as “Byzantine.”

Rep. Bernie Buescher, D-Grand Junction, said the way Colorado divvies up its mineral revenues is so convoluted that he doubts any piecemeal reforms could yield meaningful results.

“I, for one, would rather throw this whole thing out,” Buescher said.

“We ought to come up with one method that finds some consistency and some understanding,” Buescher said.

The interim committee’s leader, Sen. Gail Schwartz, D-Snowmass Village, said it certainly is within the committee’s scope “to look at reconfiguring the formula to something that might be more practical.”

The State Severance Tax Statute 39-29-101 reads:

It additionally is the intent of the general assembly that a portion of the revenues derived from such a severance tax be used by the state for public purposes, that a portion be held by the state in a perpetual trust fund, and that a portion be made available to local governments to offset the impact created by nonrenewable resource development.

Sounds simple enough until one realizes the amount of money being collected and distributed -over $200 million dollars in 2006.

Nothing got more complicated when legislators, especially in the pre-Referendum C years of TABOR, needed to finance state programs from other funding resources like the severance tax.

How difficult will the process be if legislators decide to “start all over” on the state and federal severance tax allocations?